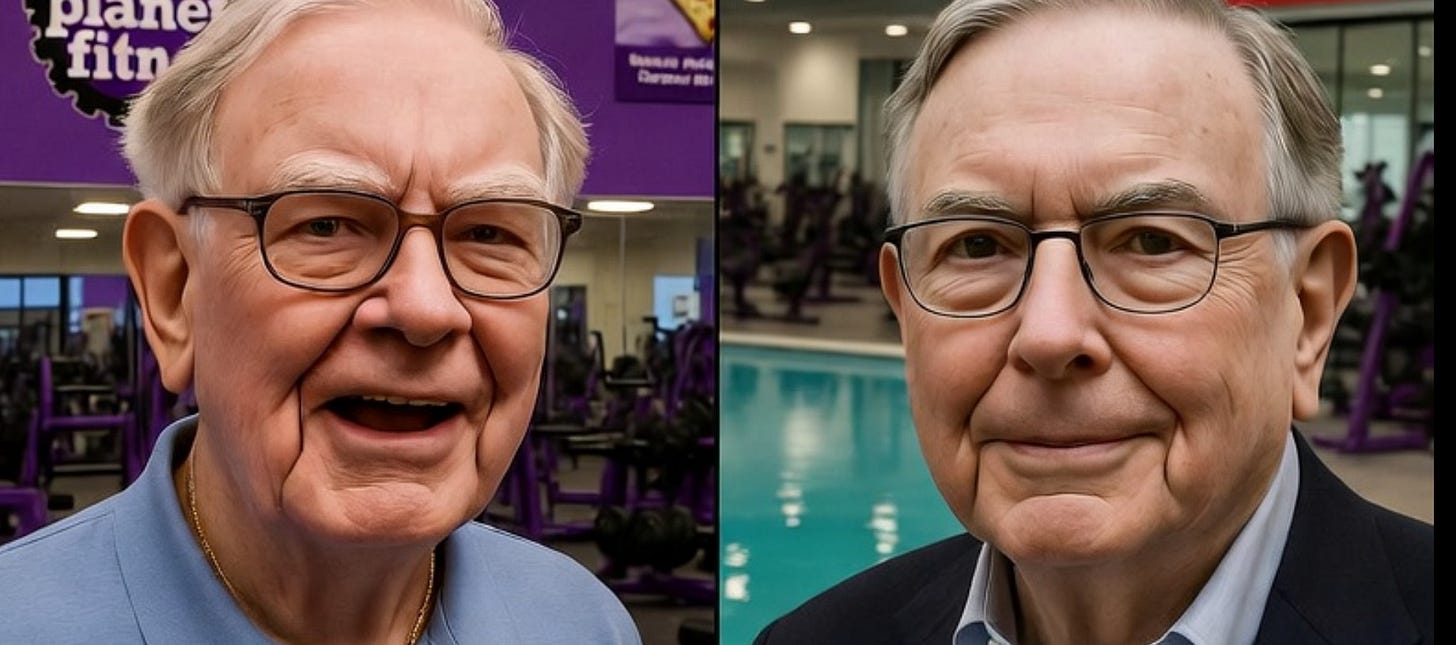

Buffett Takes His Daughter to Planet Fitness. Munger Calls an Uber to Life Time.

Time was short today. I had this research report that I did to share with you and I thought it’d be funny if I shared it with you through the story of two famous Value investors. It’s my version of two characters walking into a bar, but instead the gym.

Let me know what you think and I’ll create more.

Warren Buffett walks into Planet Fitness with his daughter like a man entering a Costco on a Tuesday.

Confident. Cheerful. Slightly too excited about the price.

The walls are purple. The music is Top 40 at a volume engineered not to offend anyone’s litigation department.

The Lunk Alarm hangs there like a toddler’s discipline tool. Not for the toddler. For you.

Buffett looks at the sign and smiles.

“At ten bucks a month,” he says, “this is cheaper than my daily Cherry Coke habit. Also I hear there’s piazza protein shake. That’s what I call a diversified health strategy.”

Charlie Munger scans the room the way a bankruptcy lawyer scans a casino.

“Warren. This isn’t a gym. This is a recurring revenue museum for people who like the idea of squats.”

His daughter whispers, “Dad, can he say that.”

Buffett whispers back, “Yes. He’s Charlie.”

Munger points at the dumbbells.

“Where are the heavy weights.”

Buffett shrugs.

“Charlie, this place is the GEICO of gyms. It’s not trying to impress you. It’s trying to keep you paying.”

Munger’s face tightens.

“I’m going to Life Time.”

And like that, we have our investment case study.

Planet Fitness. $PLNT.

Life Time. $LTH.

Same product category. Opposite philosophies.

One makes money off optional effort.

The other makes money off actual usage.

The scoreboard

Planet Fitness is smaller in revenue but freakishly efficient.

Life Time is bigger in revenue with improving profits, but it’s a heavier machine.

Planet Fitness snapshot

Revenue about $1.3B. EBITDA margin about 42 percent.

Roughly 20.7 million members across about 2,800 clubs.

Valuation rich. Around 40 plus times earnings.

Life Time snapshot

Revenue about $3.0B. EBITDA margin about 27 percent.

Roughly 890,000 members across about 185 centers.

Valuation more normal. Around 20 times earnings.

Buffett stares at the membership numbers.

“Twenty million members. That’s not a gym. That’s a small country.”

Munger stares at revenue per member.

“Yeah, and Life Time gets paid like a country club.”

The business model in one sentence each

Planet Fitness is a franchised toll road for fitness intentions.

Life Time is a company owned resort that sells identity, community, and a place to hide from your own house.

Planet’s model works because human beings hate cancellation more than they hate not exercising.

Life Time’s model works because human beings will pay a lot to feel like the kind of person who pays a lot.

Buffett nods.

“That’s just incentives.”

Munger nods.

“That’s also social psychology.”

Planet Fitness: the genius of cheap guilt

Planet is built around one brutally rational fact.

Most people want the membership. Not the workout.

So Planet prices it low enough that you can’t justify the mental energy to cancel.

Then it designs the club so beginners feel safe and regulars can’t hog the place.

No heavy barbells.

No vibe that screams, “You don’t belong here.”

The Lunk Alarm is not a joke. It’s a filter.

Buffett walks past a guy doing bicep curls with a seriousness normally reserved for bond auctions.

Buffett says, “I love this place. Nobody’s trying to be Mr. Olympia. They’re trying to be mildly less depressed.”

Munger says, “Exactly. And that’s why the model works.”

Investor lens

Planet’s secret weapon is asset light compounding.

The franchisee spends the capital.

Corporate collects royalties, fees, and sells equipment.

That means high margin growth with less balance sheet strain.

If you’re trying to build a durable public company, that’s not a bad setup.

The risk is simple.

At a high multiple, you must keep delivering unit growth, member growth, and pricing power without messing up the brand promise.

Cheap. Friendly. Everywhere.

Life Time: the genius of expensive standards

Life Time is the opposite.

Life Time doesn’t want you paying and not showing up.

If you’re paying $150 to $200 a month and you don’t go, you’ll cancel out of spite.

So Life Time builds an ecosystem where attendance is the point.

Pools. Courts. Classes. Childcare. Cafe. Spa. Co working.

It’s less “gym membership,” more “I moved in emotionally.”

Buffett walks into a Life Time lobby and lowers his voice.

“This feels like a hotel where the bellman also sells you creatine.”

Munger says, “This is what quality looks like.”

Then he says the part you noticed.

“It gives people the feeling they don’t deserve it. And the feeling they should rise to it.”

That’s not just branding.

That’s environmental pressure.

A good environment turns discipline into the default.

Investor lens

Life Time’s game is revenue per location and margin expansion.

With about 185 centers doing about $3.0B revenue, you’re talking roughly $16M per center on average.

That’s not a gym. That’s a cash producing piece of real estate with treadmills.

But it comes with the owner operator burden.

Life Time must fund buildouts. Maintain the palace. Service debt.

It’s not asset light.

It’s a high end machine that must stay polished.

The bull case is pricing power plus engagement.

The bear case is recession plus churn.

When wallets tighten, the first thing that gets questioned is the $200 monthly luxury you pretend is “necessary for health.”

The valuation lens that matters

Here’s the clean way to think about it.

Planet

You’re paying for a franchisor with a long runway.

High margin. Scalable. Great unit economics.

But the multiple is already assuming competence.

You don’t get paid for “not screwing up.”

You get paid if it compounds faster than the market expects.

Life Time

You’re paying for a turnaround that has become a compounding story.

Lower multiple. Improving margins.

But heavier capital demands.

You need confidence that new units and mature units keep throwing off cash after maintenance capex and debt service.

Munger would summarize it like this.

“Planet is easier to run. Life Time is harder to replicate.”

Buffett would add.

“Planet is the better business model. Life Time might be the better stock, depending on price.”

What to watch the next four quarters

If you want this to have real investing teeth, give readers a checklist.

Planet Fitness watch list

New unit openings and franchise health.

Member counts and churn after cancellation rules get easier.

Black Card mix and pricing power.

Same store sales.

Any brand mistakes that make the judgement free crowd feel judged.

Life Time watch list

Same center sales and dues growth.

In center spend per member.

New club returns on invested capital.

Net debt and interest burden.

Any sign the premium member is trading down.

The life lesson

This is where your personal observation becomes the closing punch.

Planet Fitness is a bet on our desire for optionality.

Life Time is a bet on our desire for aspiration.

Planet says, “Pay a little and feel okay.”

Life Time says, “Pay a lot and behave better.”

Neither is morally superior.

They’re just different mirrors of human nature.

But if you can afford the environment that makes you better, and you choose the one that lets you stay the same, that’s not a money decision.

That’s a self story decision.

Munger would say it in one line.

“The safest way to get what you want is to deserve what you want.”

Buffett would say it in another.

“Most people underestimate compounding. Including compounding habits.”

And then your best final sentence is simple.

Some gyms sell fitness.

Some gyms sell a future version of you.

Make the most of today

Eric