Gold or Stocks: Whose Going to Win?

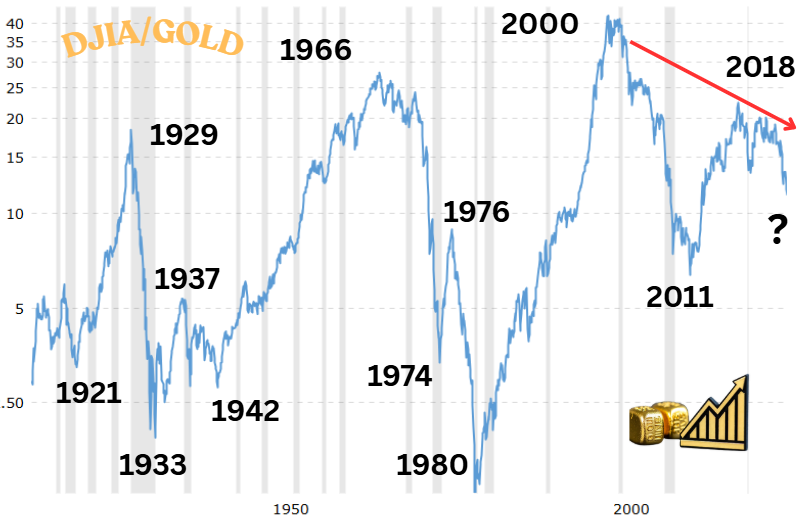

We look at Gold to DJIA for insight

My brief question to you loyal readers as to the value of NVDA, GOLD, and BITCOIN seemed to be very timely.

But try as I might, I just can’t shove my entire thesis and idea in just one image or sentence, so there will be episodes to my thoughts and recent studies, like for today, which covers the Stock Market in Relation to Gold.

If Ken Burns can roam around history and take his good old time, then so will I.

Of course, unlike him, I don’t yet have the luxury of being “generously funded by this foundation and that foundation” but we’re working on it. You can start by subscribing to this brilliant newsletter by clicking here:

Today I want to give you one concrete idea you can take home and use to impress family, friends, enemies, and that brother-in-law who thinks Nvidia goes up forever simply because he bought one share while you still have that gold watch your great grandfather carried over through the war.

The formula is easy DJIA price divided by the price of Gold during that period. I got this data from Macrotrends.net

I marked all the dates that were important for our brief study:

1921 to 1929 the great bull market to the crash of ‘29 that ended in 1933

1933 to 1937 we saw a rally that ended when we went to war 1942

1942 to 1966 we saw the greatest industrial bull market and created the first High Tech billionaire in Ross Perot

1966 to 1974 the market crashed as the war in Vietnam and inflation took its toll. Nixon tore up the Bretton Woods agreement between 1971 and 1973 which created the FX and Gold markets to trade freely.

For a brief moment 1974 to 1976 industry started to ramp as Nixon resigned.

1976 to 1980 under Jimmy Carter saw the beginning of rising rates, and inflation.

1980 to 2000 under Ronald Reagan and George Bush followed through with Clinton the entire market rallied

2000 to 2011 Bush tried to inflate our way to prosperity plus war in the Middle East but it didn’t hold up and a Real Estate crash occurred and ushered in Obama who had the right people to get the economy rallying.

2011 - 2018 Obama’s policies and Trump’s pro-business allowed the market to stay strong but inflation, yet again, kept rising and COVID just shut everything down.

2018 - 2025 Under Biden, policies that were inflationary and restrictive drove the markets lower in relation to gold. Under Trump II, the markets still see strong inflation and the trend is down.

So after trillion of dollars in AI and Energy spend, the stock market which represents businesses, employment, growth, innovation, and the ingenuity of every American is not outperforming precious metals.

From the End of Bretton Wood, here are the years up and down

Up 1974 to 1976 = 2

Down 1976 to 1980 = 4

Up 1980 to 1987 = 7

Down 1987-1988 = 1

Up 1988 - 2000 = 12

Down 2000 - 2011 = 11

Up 2011 - 2018 = 7

Down 2018 - 2025 = 7

It’s a dead heat. 50/50. Let’s look at a chart from 2008 to now.

The trend is down but may have hit support, or a chartist would say, an inverted head and shoulders.

From the news, to the people I speak with, everyone is confused. No one knows what to do. We are at a pivotal moment. It probably has to do with war and peace.

What are we going to have?

There are certainly parallels to 2000 and will discuss in other posts, but the markets are as weak now as they have been in 2008 so all the depravity is out of the market.

We have two screens:

All the President’s Men who are saying we are going to see an amazing 2026 and the chart shows this potential

Our other leaders have come up in the generation of Clinton, Bush, Obama and see the prior playbook which implies a not so rosy outcome.

At least for me, this is a time to keep studying fundamentals and key periods during the past few inflationary/deflationary times to see if there are not just similarities but ways to find lower risk investments.

Like industrial metals that you are going to need if you are going to rebuild the US but that area is so full of speculators and penny stocks, are there any larger cap companies with a good balance that will be the NVDA to this industry?

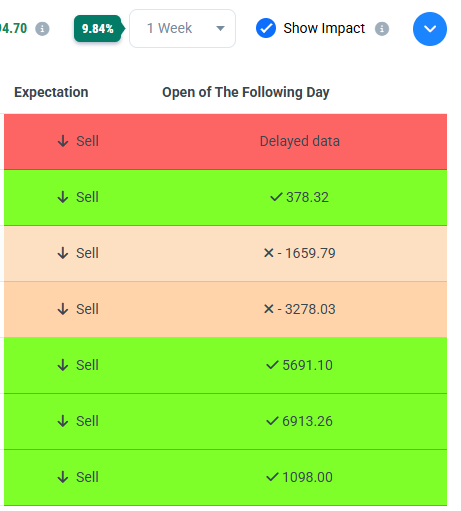

Or with AI, can you develop strategies of finding flows in and out of stocks? I believe I’m on the right track with my software.

Bitcoin went down about 7% this week while the software generated about 9%

So even with cheerleaders in the market, the software was able to define what headlines have value.

You are more than welcome to come on chat and ask a question. We are working on our own AI so you will see my journey in real time. Software is there to help, not just stock options.

Tomorrow be on the looking for a company that not many people know but feeds us on Thanksgiving.

Have a nice day

Copper is another metal to keep an eye one. Very important for the infrastructure build out governments are pouring billions into

Wow, very interesting view through a different lens! Which way do you see it going?