How Sentiment Beat Bitcoin by 50%

The headlines flipped long before the price did.

Did you know Bitcoin is up 29% since May (when I started keeping track?) and Bitcoin if you held it is down about 20%.

By the way, I rounded the title to 50% to make it nice and headline worthy. Just like a good Bitcoin influencer. Am I doing it right?

Read on and I’ll explain how this occurred and works also for stocks

If you recall that yesterday I shared my thoughts on capital flow as I was outraged by the coverage on Tether. It can guide decision-making long before the headlines start to pick it up.

Speaking of headlines…

The piece most traders are not aware of because we are not aware of it, yet we apply it everytime we read X or listen to the news:

Sentiment.

And, if there was anything that is NEW for a trader it is that. Before a sentiment indicator would only be related to a broker, a survey, a website but not consistently to the headlines news streaming through the day.

It’s not possible for a human to keep track, read, process, and score all of this. Only hedge funds were able to with their large budgets. But now with Ai models from China to US you can do this. But you need to be consistent.

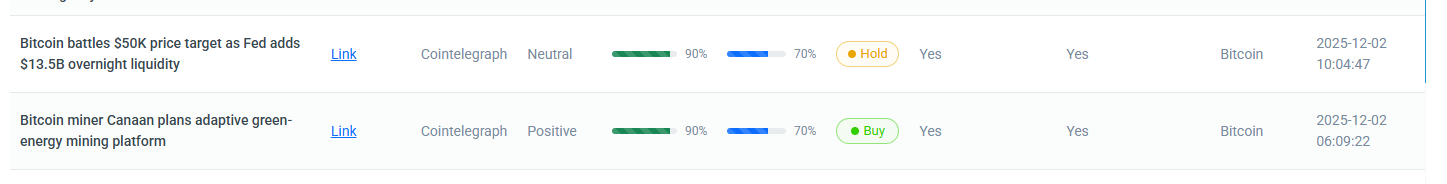

What I did was automate it and find ways to lower the cost and maybe add a few years of my experience to it. This is the reason I’m sharing with you the software I developed.

By using daily headlines to time your purchases, and sales, you should be able to participate in BTC movements without all the emotion.

Bitcoin traded at 108,992 on May 27.

Today it sits around 87,683.

That’s almost twenty percent gone.

If you traded only the extreme sentiment windows, your performance was better.

Time frames are important and I found a window to buy it at and a window to close the trade and that’s it. Two clicks. One to buy and one to sell.

The assumption is:

Sentiment leads.

Price follows.

Everything else is noise.

The performance shown is if you owned one BTC

And it’s not a black box you can see the headlines we use and review them yourselves. We even created a features that allows you to add/subtract feeds based on your criteria.

Getting data and connecting it is very expensive especially when you outsource it to third party AIs which charge on everything. So I bought my own machine which is why all of a sudden AI makes sense.

If you understand offshore dollars + human psychology, and wait at least a day you should be able to beat most of Wall Street.

We’re not building a toy.

We’re building something that tells you why capital shows up, when it shows up, and who is afraid.

Tomorrow, we’ll zoom out again.

But today, it’s enough to see the link:

Sentiment ↔ Capital Flow ↔ BTC Direction

Sovereign AI is being built around that triangle.

Question of the Day

Do you think sentiment leads capital flow, or capital flow leads sentiment?

There’s no wrong answer — I just want to see how you think.

Have a good day