How to reframe "Can it go much higher?"

If you are making too much money quickly or missed out on the freight train, an important question must be asked

The family and I were at the mall Sunday, waiting for an elevator that couldn’t make up its mind—up, down, or maybe sideways for all I know.

European guy next to me says quite slowly with emphasis, “Whatever goes up must come down.”

And I thought, well… yeah, except sometimes that kind of thinking makes you broke.

If you’ve ever bailed out of a market just because it “went too high,” you probably missed a great run—or worse, lost money doing the opposite.

Right now, almost every market that matters—stocks, crypto, metals—is going higher. If you’re young, you don’t care. You’ll “figure it out later.” The rest of us? We remember market crashes. We get that uneasy feeling when prices are sky-high.

What I’ve always found fascinating—and maybe some grad student should do a case study on this—is the “HODL” crowd. (Hold On for Dear Life.) These folks watch their investments drop 80–90%, sometimes over years, and still hang on. And here’s the kicker: a lot of the time, the thing comes back and then some.

So, you’ve got to ask: why did they hold? What made them sit through that kind of punishment?

I think the smarter question is: Where will this be in 10 years?

As an added emphasis, I knew a guy who ran a very successful metal tube manufacturing company. He could’ve retired a hundred times over, but instead, he’d ask his managers, “Where do you see this business in 10 years?” He wasn’t thinking about what was in the bank. He was thinking about where the whole machine would be down the road.

That’s the mindset—vision and patience.

Sometimes the best action is to sit on your hands and do nothing. Jumping from one shiny object to another? That’s how you kill your own vision.

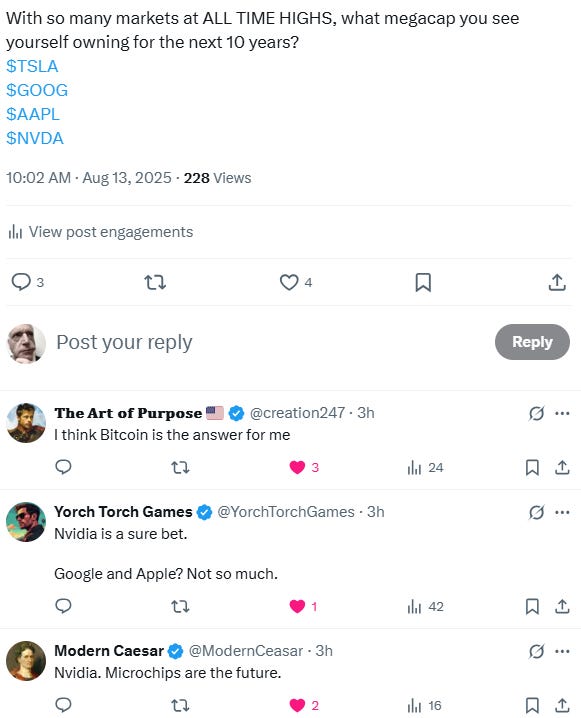

Here is how some followers of mine answered on X today

Here are some of my impressions:

Nvidia? Sure bet.

So, with that positive vision, consider the impact of big sell-offs, such as those seen earlier this year. Every time, ask: are they still innovating? Is there anything in history comparable to this kind of buildout?

Google and Apple? Not so much.

What he’s saying is “I don’t think the iPhone or search monopoly will hold 10 years from now.”

Bitcoin? I was in at $10, thought it was the best unit of exchange ever, didn’t see it as a store of value. My friend did. Guess who’s laughing?

Of course, someone on X isn’t going to give a dissertation. But the logic has to hold up within your worldview. I would say he is going with the positive vibe Bitcoin gives off. If that vibe or a turn of events occurs, it might be time to jump ship.

Microchips?

Digital life needs them for everything. But every manufacturing industry goes through cycles. Are we in a super cycle that may take +10 years before caput?

Tesla?

You have to see past the numbers. It’s not just EV cars—it’s robots, self-driving, solar, batteries, charging networks. The amount of time to see the future is way past 10 years, don’t you think?

To summarize, everyone thinks 90% drops always rebound. They haven’t in a long time for the strongest asset class, so maybe we’ve all gotten a little cocky. That’s potentially dangerous.

Before investing, here are some things to do and ask yourself:

Does it excite me?

Are there business cycles?

Has the story changed? Reading a few headlines is enough to get the idea.

Now, after what I wrote above, you are still craving the action of price movements. No problem. I encourage it as well. Who doesn’t enjoy seeing your decision-making pay off in real time? My point is that at a certain point, it may be addictive and eat away your precious time, which you never have enough of.

I argue that if you are going to focus on price behavior, then at least follow this: when you make a 100% profit, sell half. Now you’re playing with house money.

And if you really like action? Sell a little every time it doubles. Keeps you busy.

There is never a good or bad time to start. You can join the party in a rising market—in fact, the famous saying is “the cure for higher prices is higher prices.” Just remember and recognize, you’re not early. That means using discretion: diversify, allocate smartly, and be satisfied with whatever outcome your plan yields.

The market is always about the future. The winners tend to be the ones who plan for it.