If you can't win the game

Change the rules

So says Vishen Lakhiani, a motivational speaker and in a former life a Central Banker.

Walk with me into a hotel room in 1985.

The air inside the Plaza Hotel smelled like old carpet, cigar smoke, and the nervous sweat of men pretending they weren’t about to rewrite the world.

Five finance ministers stood around a too-small table — French, German, British, Japanese, and American — each pretending to read a briefing folder but really watching everyone else’s hands.

It felt less like diplomacy

and more like the opening scene of a heist film.

Someone was lying.

Someone was bluffing.

And someone — everyone — knew the U.S. was about to pull the oldest trick in global finance:

“We’re changing the rules. Act surprised.”

The Japanese minister kept straightening his tie.

He knew what was coming even before Baker said the words.

The yen was about to rocket higher and crush Japan’s exporters — politely, with signatures and fountain pens instead of tanks.

The British minister cracked his knuckles like a man about to confess to something he didn’t do.

The French delegation whispered to each other in a corner, certain they were the only adults in the room.

And James Baker stood there like a blackjack dealer who already knows the whole table is about to go broke.

The Plaza Accord wasn’t a treaty.

It was a controlled demolition.

The dollar would fall.

America would get breathing room.

Japan would get the bill.

And the world would pretend it was “cooperation.”

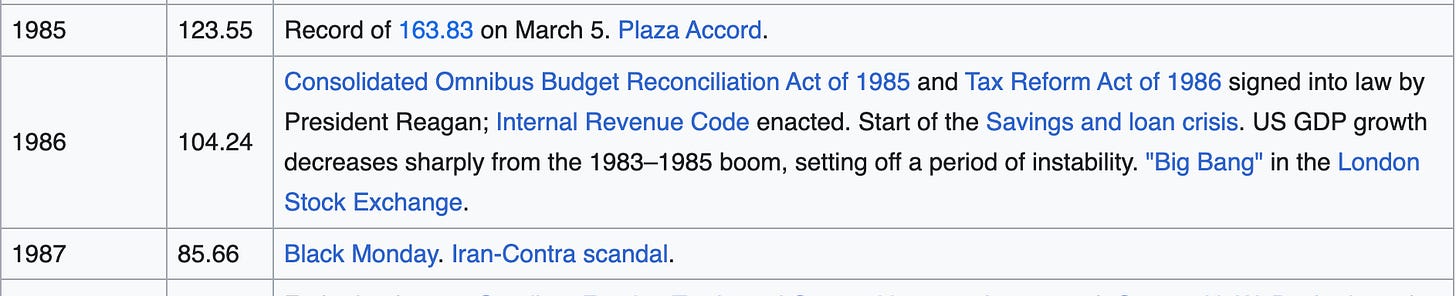

From 1985 to 1987 the US Dollar went from 123 to 85

Now let me introduce you to someone who wasn’t in that room:

Kenji.

31 years old.

Assembly-line worker at a plant outside Osaka.

Saved 12% of every paycheck.

Read the newspaper every morning on the train.

In 1985 he thought his country was winning.

The factories were booming.

Land prices were rising.

His supervisor told him Japan would own half the world by 1990.

Nobody told him a group of men in a hotel suite had just decided to rip 50% out of his currency.

Nobody told him his savings were being re-priced, not by markets, but by strangers smoking cigars under chandeliers.

Nobody told him the scoreboard wasn’t real.

And now fast-forward to today.

Meet Alan — 63 years old, American, retired Navy machinist.

Saved for decades.

Bought “safe” bonds because everyone told him that’s what responsible adults do.

In 2024–25, he didn’t lose money.

He watched his life’s work get set on fire by inflation and interest-rate whiplash.

He watched the Fed pivot, then stall, then panic, then pretend it wasn’t panicking.

He watched the same game Kenji watched:

men in rooms making decisions that erase a lifetime of discipline.

And just like 1985, everything around him revalued:

Gold soared.

Bitcoin escaped orbit.

Stocks behaved like they were floating on a balloon.

Even corporate debt — the “safe boring stuff” — started acting like a carnival ride run by a drunk teenager.

We already lived through the asset remix.

The only thing left to reset is the dollar debt.

Everybody feels it.

Nobody says it.

Tariffs are back — not as policy, but as a revenue engine.

Foreign central banks are pausing like they’re waiting for permission.

The bond market looks like a battlefield after the smoke clears.

And half the financial world is staring at the Supreme Court like a ship waiting on a lighthouse. (No one knows if Trump’s tariff policy will be reversed)

History is humming the same tune.

Not loudly.

But unmistakably.

And here’s the metaphor that hurts — because it’s true:

**A monetary reset is like showing up to a baseball field you’ve played on your whole life… and discovering the bases have been moved overnight.

Not because you cheated.

But because someone decided the game needed “adjustments.”**

Kenji felt it.

Alan feels it.

And millions of Americans will feel it the moment the dollar is “recalibrated” for stability, competitiveness, or whatever polite word they choose this time.

1985 was the rehearsal.

1987 was the correction.

This is the main event.

Everyone is waiting:

the Fed, the Treasury, foreign governments, Wall Street, and yes — the Court.

The only question now is the one nobody can escape:

**When the music stops, will you be standing in the right currency…

Seize the Day

Eric