Is JP Morgan to Big to Fail?

And will MicroStrategy become the GrandStrategy

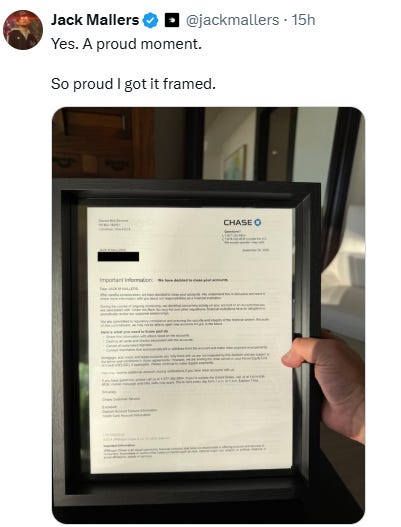

I read this weekend that JP Morgan quite specifically debanked a big Bitcoin player and friend of the bitcoin ambassador of Trump.

Grant Cardone the billionaire salesman (among the greatest) also took a leave of the bank.

I also read that JP Morgan sold shares of Micro before news of delisting risk from major indices as it is more a treasury stock than a business.

These moves are shock and awe.

Rumors are that JP Morgan has a huge short position on MicroStrategy a a 50% up move can create some financial disorder for the bank.

The same bank that is famous for manipulating commodities and other markets, lets take a look:

Derivatives Cartel (2005-2008): The European Commission imposed fines on a group of banks including JPMorgan for participating in a cartel in the euro interest rate derivatives market.

Precious Metals and U.S. Treasury Futures Manipulation (2008-2016): JPMorgan was fined a record-breaking $920 million by U.S. regulators for a multi-year scheme to manipulate the precious metals and U.S. Treasury futures markets. Traders used a practice called “spoofing,” where they placed large orders they never intended to execute to create a false impression of supply and demand, thus manipulating prices in their favor. The bank admitted wrongdoing in this case.

Foreign Exchange (FX) Market Rigging (2007-2013): JPMorgan was among several major banks fined for colluding to manipulate foreign exchange rates. The bank was fined approximately $996 million by U.S. and U.K. regulators in this case and admitted to a criminal felony count.

USD ISDAFIX Manipulation (circa 2010s): The Commodity Futures Trading Commission (CFTC) ordered JPMorgan to pay $65 million for attempting to manipulate the U.S. Dollar International Swaps and Derivatives Association Fix (USD ISDAFIX), a global benchmark for interest rate swaps.

California Electricity Market (2010-2011): JPMorgan paid a $410 million penalty to settle charges related to a bid-rigging scheme in the California electricity market.

So why shouldn’t it do it with Bitcoin and Microstrategy?

Especially, since Jamie Dimon, doesn’t like it.

Wouldn’t it be ironic the same bank that bailed the US out of 1907 will go broke ushering in a new form of banking and transactions? Trump won’t bail them out but will most likely bail out and own MicroStrategy’s bitcoin stash at a discount.

For this to occur, we need to see a complete and utter collapse of BTC and MSTR.

Or it will rally and, all is well, then you need to look at this chart daily to see where breakouts are.

Need further proof?

When you see news that are just negative about the leader of the free world and his financial savvy (he’s doing trade deals after all). Apparently the news didn’t remember what Buffett said, “Never to bet against the USA” And the President represents our interests.

Then there is Scott Bessent who doesn’t just talk, but also does sales calls.

Finally, the best value investor that not everyone has heard of, Bill Miller, and his son, just keep buying BTC (and own shares of MSTR) since 2012:

Come over to the chat, and we will go over what we see today, or ask us a question.

Hope this helps clarifying a few things.

As for paid subscribers, I’m trying to finish the report on BTC and the Future relevance of it and what catalysts they can be.

You will find things not discussed in public discourse.

Interesting read Eric!

Value as always