Lady Gaga's Secret Economics Degree

How bad do you want to own Bitcoin?

Lady Gaga always puts me in the mood. And no, you degenerate, I mean in a mindset to be entertained. She’s a great actress, singer, and performer. But why?

She forces you to stop and listen. And also the subject.

The topic of her songs are relevant to so many parts of our life.

Her recent song is important for an investor; especially when markets are not going up.

Using Bitcoin as an example:

“Other than people telling YOU to buy Bitcoin and WHERE it’s going.

How bad do you want to own it?”

One way that most people don’t develop a habit in is with math. Fear! Don’t worry the math is easy and not headache worthy.

Usually, when math is presented to investors we already give up. The media overwhelms us by making us feel small by lording over us Greek names, mysterious sounding words (quants, regressions, and statistical models where the symbols are confusing) along with not being a 14 year Chinese hacker. Then they put on TV bros with hoodies and yellow shiny ties , after you have a headache, and blare out slogans “Buy” “Going to a million bucks” It’s a bit easier to digest.

To show you how shallow these individuals are. If you visit their exchanges, say Coinbase, it’s all automated, all very cold-impersonal, and a response can take several days (but not to close your account). But the ceo or someone high on the organizational chart will come on TV sincere and tell you what’s up. Or be a bro, and help someone out on a Kalshi bet (just not on his exchange). Building rapport is a bottom to top kind of deal. Their model is a “do as I say, not as I do” kind of deal.

The same psychology that overwhelms with math, and predictions, goes hand-in-hand fear. Fear of the unknown I would prognosticate (you get that $5 word for free today) but just a few minutes of your time would help calm a steady nerve (no need for whiskey).

Probably has to do with the growing popularity of horror movies and Halloween. In order to enjoy, you have to suspend your disbelief which means train your mind not to think but feel. Business and flying airplanes requires a little more than that. While you may get a feeling from the music, it is a business and the industry is known to be “formulaic” since if it worked for one singer, why not for another? Gaga has a formula she has worked hard on. 70s, Pop, with an Skew (that’s another statistical term).

Gaga’s new hit song features a very Halloween filled dance directed by Tim Burton of Beetlejuice fame and also shows up in WSJ article on this subject

Am I making this up? or prognosticating? Not at all. The WSJ covered this trend earlier this year with Lady Gaga in the title.

Wouldn’t you know fear and economic doom (AI, Inflation, Tarriffs, etc) is something that we may just subconsciously crave but does not reflect reality that you can exploit once you figure out the numbers.

Thankfully, you do not need to be confused. The math is the largest most public data about the economy and even easier now with ChatGPT.

After you get the numbers, you have to put it into perspective. Unfortunately, the numbers being thrown around these year are so large they are hard to fathom. The more the term trillions is thrown around loosely in the media, we mindlessly accept that number without any frame of reference.

What’s the largest number to express our noblest ambition, Love?

Throughout history all our great artists stopped at millions and anything past the words used were infinity, forever, immortality.

The highest number Lady Gaga used is a million

Million Reasons” – Lady Gaga (2016)

“I’ve got a hundred million reasons to walk away,

But baby, I just need one good one to stay.”

And with that segue (you wouldn’t expect less of an entertaining show or essay)…

What is the one reason to own BTC?

The three main arguments are:

***Is it a productive asset? Is it a currency? Is it a storage of value?***

(All info is related to the USA only, unless noted)

So lets review, briefly, all three.

Lets start with BITCOIN = 2 TRILLION DOLLARS

The highest prediction for BTC is 10x, or $1,000,000 per token, or 20 trillion dollars. And, as I mentioned yesterday, if BTC is valued at 20 trillion, imagine all the other tokens valuation?

Productive Asset?

GDP 30 trillion

GDP of the USA is Productivity

Total debt 38 trillion

The borrowing of US government in order to be productive

Total real estate 55 trillion

The value of where people sleep

Mortgage 13 trillion

The amount people borrowed to sleep “free”

Total stock market is 68 trillion

The value of all the public traded assets in the US

Estimated private businesses is 14 trillion

The value of businesses people work day to day without the liquidity of shares

What do you see?

My impression is that if BTC becomes valued at 20 trillion then it will basically be as valuable as the USA. The largest and mightiest country that has ever existed. And be valued as much as the entire housing industry?

Currency?

Total commodity market is 60 trillion

Total US Dollars worldwide 8-9 trillion

BTC is already on par with US dollars, but not like US Dollars. Forbes wealthiest priced in BTC?

If it goes to 20 trillion dollars it as if it has assumed the powers of the entire commodity market. And commodities feed you, shelter you, drive you to work, and clothes you.

Storage of Value

Total Gold held by central banks 5 trillion

Total Bonds held by central banks 7 trillion

Inflation is 3%

BTC is already the same value as Gold and Bonds. Amazing. So it will be worth MORE than Gold? China will sell all of that gold they just bought? and Bonds that fuel the entire economy won’t get a bid and the entire industrial world will plunge into a sustained deflation?

Freedom Index

If BTC was there to help Lady Gaga would be the first to promote it (not just her private keys as she did in 2020) as she is very well known to be a social justice warrior.

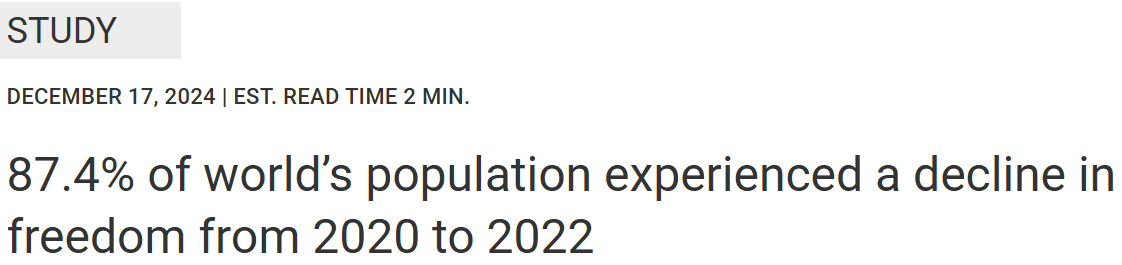

Lets look at the trend of freedom that last few years:

I thought Bitcoin was there to help? Didn’t it go from 7,000 to 100,000

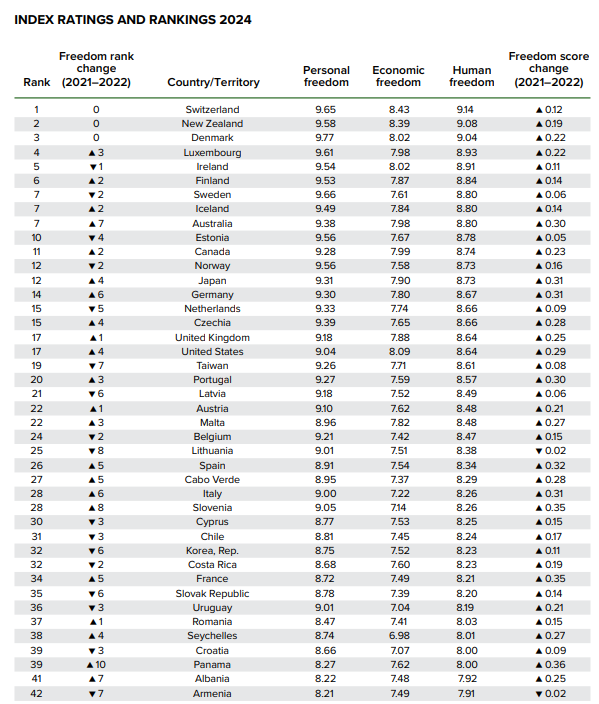

Now lets look at the latest rankings of countries by Cato Institute:

Where’s El Salvador?

Am I saying not to buy? Nope. It’ll probably go up for something I am to smart to know about. But I feel the odds of mindlessly buying something is a lot less than doing the homework and having the numbers in mind when a sell off occurs.

As the Lady says in Rolling Stones:

BTC is probably going to be a Yo-Yo

So from what everyone is saying where it’s going from Donald Trump to the guy at McDonalds (maybe that’s where Trump got his idea?) to Peter Schiff and CNBC Ross Sorkin who believe its near worthless, Im going to take the middle path and say that

Bitcoin is a trade. It will be used for commerce in some way and as a result it will be trading probably like a currency. It is no longer king.

During the Great Recession, an economist wrote about “The Lady Gaga Economy” — how even in a collapsing economy, she created a thriving niche for her concerts and performances because demand for something scarce always survives. There is no “general glut.” There are only misallocations. Some things rot. Some things explode.

That’s the real lesson today. A multi-trillion dollar asset is not scarce.

Markets may crash. Narratives may flip. Politicians may try to stimulate, regulate, manipulate, and prognosticate. But pockets of value always remain, and they reveal themselves the moment you put actual numbers and human interest next to the hype.

Bitcoin destiny is to behave like what it actually is: a global tradeable instrument with scarcity baked in, not the entire U.S. economy in digital form.

If you understand the numbers, you won’t fear what you are holding. And if you understand the demand cycles, you won’t worship it either. Or start going to Church on time.

In economics, just like in pop culture, the rules and principles are not magic.

They’re simply born that way.

(I couldn’t help myself)

And what was born today? Software to help analyze the expected demand for crypto and stocks. I’ll be sharing what we are doing and the results in Chat and at the end of my Essays.

For paid subscribers, they will be receiving more of a deep dive on things we discuss broadly, well worth the $5 a month.

Unless I’m mistaken, I really don’t see this type of consideration on valuation really discussed. Let me know your thoughts. Have a nice day.

Thank you for sharing