Mr. Beast knowledge is Limited

Can the same be said of traders?

Do you ever consider what clickbait you decide to investigate more? I am a subscriber of Rick Beato’s YouTube channel as I hope to one day have a deeper appreciation of music and maybe rock it on one or two songs, but this year, I literally didn’t give him 5 minutes of my time until I saw this YT clip:

Mr. Beast, the famous YouTube influencer whose channel I think is worth $1 billion and who accomplished this through a laser-like focus on data and analytics, apparently doesn’t know who Prince is. This tells me that Prince is not important. No one cares for his art except people who probably paid for his CDs and went to his concerts. It also shows what it takes to be successful online in this modern day - what the present-day opportunity is. No looking back. Each day is its own world and yesterday is a forgotten dream. Kind of morbid, but I don’t make the rules. Rick Beato is reminding us that Prince may not be with us, but he left a musical legacy that many will drink from but the trader (Mr Beast) will profit from when he sees it pop up in his analytics.

The stock market had a big selloff and multiple down days. In fact the headlines said not since “Sept 11 2001” when it was heading into 9 straight down days and now not seen since 1978. History and life lessons have a way of reminding folks of humility.

But even with this life lesson, the fact is that the market has been in a generational bull market that has enriched anyone who has kept buying all the way up. Things won't just change after 10 days, but it’s something to keep in mind. Yes, you may not make as much as the next guy who is long only with blind faith because you have some experience and a life lesson, but hopefully, you will have some balance and appreciation for what you did invest in, and that is saying a lot.

With one month until what could be a new governance pattern in the USA and the West, why should people not take some profits off the table?

And if this was not enough, even Jim Cramer today on CNBC, when I listened briefly, wasn’t talking up the market as he usually does during market selloffs. He was also concerned about the gambling element of investing and didn’t care for the Robinhood crowd. He just realized there is an anonymous stock trader hotline to help degenerates who need to calm down their trading. He even mentioned how his father lost his shirt on some stock many generations ago. His sidekicks asked him if he is throwing in the town and should have a weekly instead of daily show since it’s hopeless for individuals to profit? They also mentioned how sports gambling and analytics seems to have the same kind of crowd as day traders and that FanDuel should combine both. It sure looks like data analysis (as opposed to understanding a company), and chart trading keeps it simple enough for people to wager their hard-earned income. A trend in motion is hard to stop.

As for the market “surprise” the time for caution has been lingering for a few months. But caution does not mean you stop reading, stop observing, and begin to panic. Have confidence in the data and what you own. If you don’t then hedge or take a little off the table. The market had huge rallies this year, and there is no shame in booking a profit.

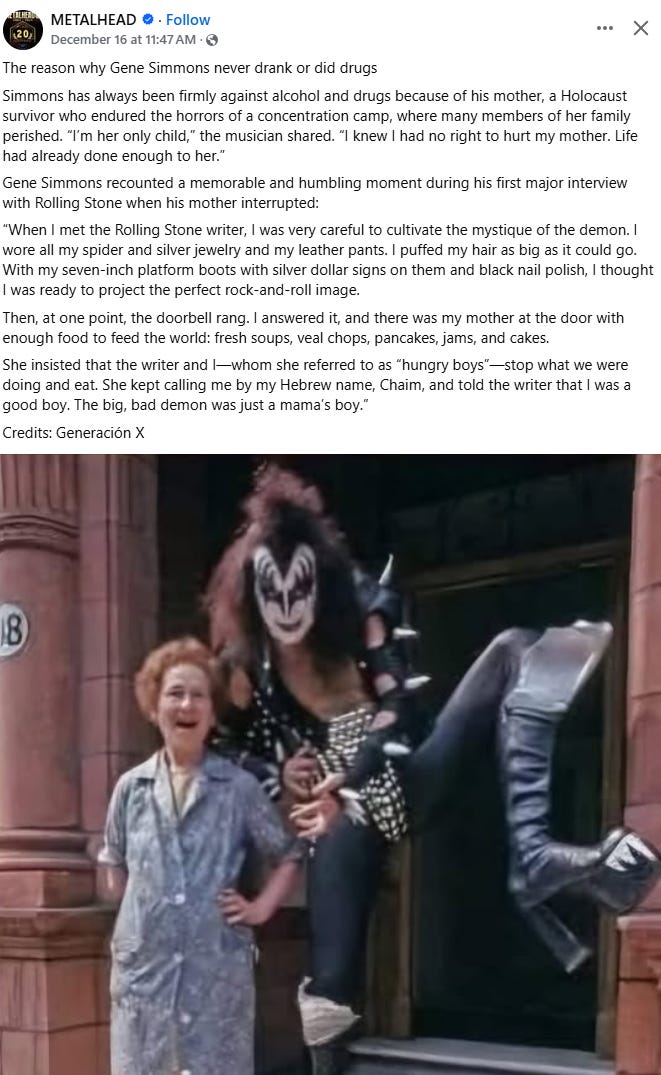

There are headlines, and then there is real history…KISS (Keep it simple) - I find that Gene Simmons not drinking or doing drugs hard to believe but he understood his history.