"Stablecoin" is the Dumbest Word in Finance

But it sounds smart today

Have you ever played the game “What’s wrong with this picture?”

Here’s your chance as I share with you a collage of images with thoughts on them as to we are entering a period of Dumb and Dumber unless you stay on your toes so lets start:

What’s wrong with this picture?

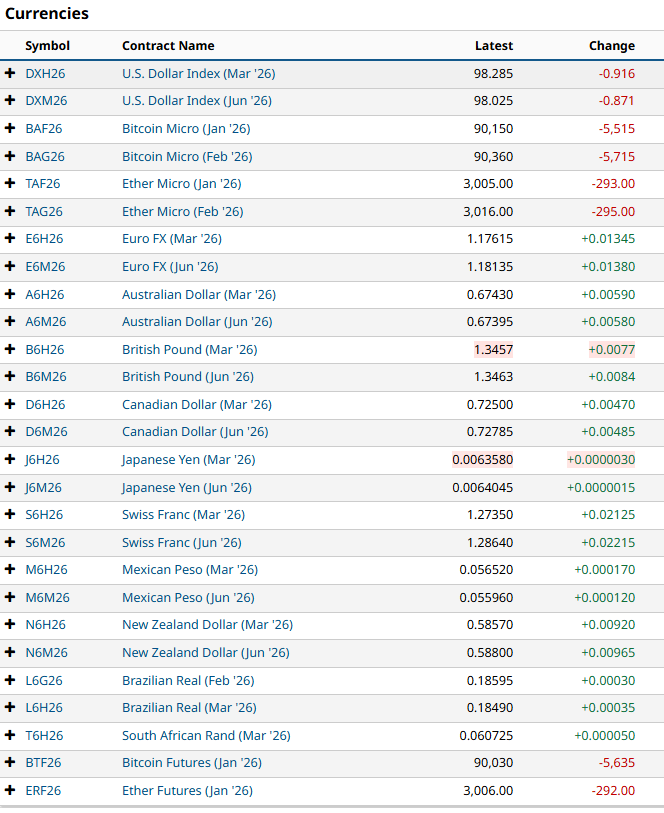

Notice anything?

After about 20 years in existence and Ether less, it’s now a currency. Where is Gold? Where is Silver?

Ah, that’s a precious metal. We don’t like ‘em up in Wyoming.

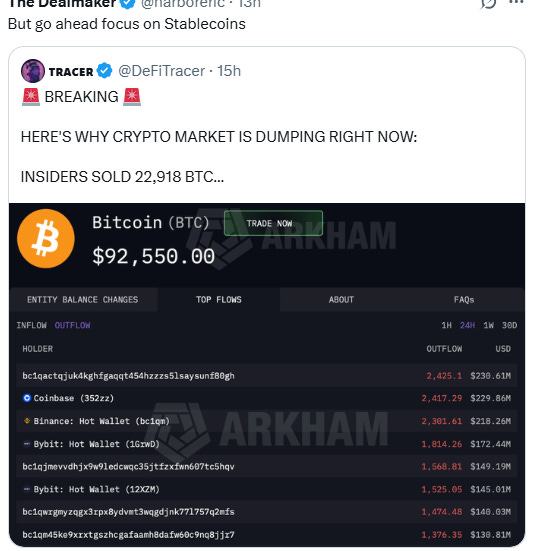

This lovely lady is touting a Bitcoin reserve as BTC gets hammered, and JP Morgan, and every other financial elite says it has proven itself. We have gone past the sale to inevitablity. Yet where was everyone as it went from $1 to $100,000?

Hasn’t anyone noticed that Gold and Silver have surged, shortages abound and there is true industrial demand.

As I wrote about before I really believe the OG bitcoin bros are selling and buying precious metal like there is no tomorrow. And if you Google it, supposedly, they do not want to tax Bitcoin sales, so a billion profit is tax free. Something to research.

SECURE

And now we have all these Crypto acts expected to be passed? not passed? by Congress, specifically STABLECOINS.

Didn’t my example above show you that subtle identification and confirmation doesn’t mean your investment will go up. Not only that after what we saw do you really want a BTC reserve by selling Gold?

And do you really BELIEVE that stablecoins are, well, stable?

Do you understand what “Self-Custody” really means and the exremely high danger it will be for anyone going out in public?

Let’s start here. If you call something stable that isn’t backed by a real asset, isn’t insured, isn’t reversible, and isn’t enforced, you’re not innovating. You’re marketing. Stability is not a vibe. It’s what’s left after panic.

Yes, the token is tied to US treasuries, but what does that mean? Do you really have the full use of it? And did you know Treasuries move in value from day to day? Is the US going to send its army to defend a stablecoin?

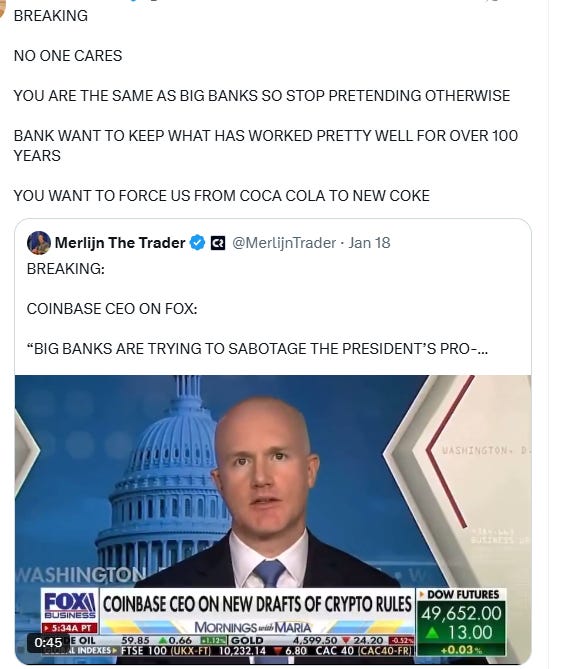

And what really gets me going is that the gurus and ceos of large crypto companies were on just a month ago touting a million dollar btc price and since that didn’t go well they are now talking about stablecoins and ragging on banks.

“Banks are the problem and we are going to solve it.”

“We?” isn’t crypto supposed to be decentralized?

We are in a period of time, like the 20s (1920s) where famous people were studying and thinking about currencies.

From my book club, Benjamin Graham would’ve thrown this out in one page. He didn’t care about speed or elegance or clever. He cared about anchors — assets, earnings, replacement cost, margin of safety. A “stablecoin” backed by Treasuries and promises? That’s a claim on a claim on a claim. You can audit it every second of the day. So what. Monitoring abstraction doesn’t make it real. It just makes the illusion legible.

Additionally, the US treasury needed Congresses help to have value. It was by law that Congress mandated the newly formed Federal Reserve during WWI to buy treasuries. Until that time the Fed could buy business debt. It had more flexibility.

Graham would ask one question and end the meeting: “What is this worth when confidence disappears?” Silence.

Even if I’m nuts, and completely offbase, I do not see anyone have a negative opinion or think things through.

The discussion of what the Federal Reserve can own and not own was on many people’s mind.

The famous inventor Thomas Edison, who happens to have provided the largest gain in history of 19 billion dollars to a hedge fund this year (2025) through the company he founded, known as General Electric (heard of it?) wanted a currency backed by things people use, the essentials of life. Things that you put in your mouth and in your pocket. Stablecoins don’t do work. They move symbols faster. Speed is not strength. You may want your money to work for you, not crash into a wall.

IS THIS INFLATIONARY? DEFLATIONARY?

This is where people get soft about deflation. Stablecoins are not a proven asset and right now money that’s parked in banks are loaned out for mortgages. This is the backbone of our economy. Anything that will mess with it, even doubt, could create a 2008 deflationary crisis. What happens if like Saving and Loans scandal, the stablecoins were used for other purposes?

Banks are an easy target. Banks aren’t sabotaging nothing. They have been in business and have adeptly handled every economy that politicians have provided. They are the ones that are in every community in the US and engage with customers daily. Coinbase is faceless and their support is automated. You don’t get the right to say this unless you prove otherwise.

Like everyone whines about bank fees. Please. Most retail customers barely pay anything. The costs are pushed onto businesses — merchant fees, chargebacks, compliance, fraud absorption. That’s insurance. Crypto isn’t cheaper. It just dumps risk on the user and calls it empowerment. That’s not progress. That’s uninsured exposure.

SAFETY

Scott Adams, may he rest in peace, recommended watching the documentary Wyatt Earp and the Cowboy War and boy what a tip. This Netflix show revealed the facts, not what the papers or movies depicted “the” sheriff and the outlaws he was hired to rein in. The “Cowboys” were colorful outlaws and the mafia in those days. They robbed stagecoaches, controlled territory, outran local enforcement. Sound familiar?

Probably not just in the movies for you. The US has done a good job in removing crime from the streets.

But what if everyone now has their money in decentralized wallets on their phone? That means it’s not insured and whatever you have in your pocket you have to defend from a pickpocket or mugger. Crime can surge.

Haven’t you seen the origin of Superman? THe creators parent died from a gun shot. Batman’s origin was a thief trying to steal his mom’s jewelry.

Here’s the part no one wants to say because it kills the mood.

This is deflationary. It will save financial institutions fortunes in fees and insurance but it won’t help you. There is a reason why our economy developed as it has.

In Tombstone, where Wyatt Earp hung his spurs, regular people were powerless. Law was optional. Security was private. Nothing changed until capital got nervous. Then J. P. Morgan and the U.S. government aligned interests. Federal troops arrived. Not for justice. For commerce. Order always returns when money is threatened. Always.

Do you want to go back to those days?

What about paid protesters? Aren’t you seeing all the protests now? What if a gang sees a potential pocket of wealth and creates protests that the media support and then they under the cover of “chaos” rob the neighborhood through violence (probably have to force the owner to hand over his secret keys)

If your entire financial life lives on your phone, and theft is final, and recourse is nonexistent, and enforcement is slow, crime doesn’t need sophistication. It needs proximity. That’s not cyberpunk. That’s street crime.

So the inability to finance, get a loan, and irrreversible money can create a supernova of deflation. That’s not decentralization. That’s feudalism with QR codes.

COINBASE

Here’s the uncomfortable truth about Coinbase. They don’t have a story anymore. They have a posture. “We are the largest so trust us in our opinion of what is a good or bad bill” “Trust us, we’re building the future.” No you’re not. You’re trying to get past the security desk. This is Godfather Part III where Al Pacino is trying to get the Vatican to sell their real estate to him so he can go legit.

When I saw this headline, I was flummoxed. Now you want to talk to the banks? What the hell are you thinking? You have to work with people. They have all the nations savings and you want to mess with that?

Another tweet by ceo of Coinbase epitomizes this.

Does any of his points help you or me?

Have you seen the state of the world and just the ability to state your opinion on social media? But have economic freedom?

Just google search if your funds really free by owning tokens.

We already have amazing and wonderful structure. What will improve? Please share.

Democratization? How will this help? Normally it helps the big boys and another way to lose money for retails. Where is the education. These are just slogans.

So where do they partner with as he is talking up the USA? Bermuda.

Didn’t FTX work in those banana republics? I hope the US isn’t next.

A MAN OF THE PEOPLE

While Coinbase pitches partnerships on Fox News, Jack Dorsey is showing what Bitcoin can do by building protest infrastructure on blockchain. Bitchat doesn’t need WiFi. Doesn’t need cell towers. Doesn’t need functioning government. Messages bounce phone-to-phone via Bluetooth. That’s not a payment rail. That’s preparation for what BTC is intended for.

And it proves the point. When Dorsey builds a tool that works without infrastructure, he’s admitting what the stablecoin crowd won’t — crypto’s real utility isn’t replacing money. It’s functioning when money stops meaning anything. That’s not innovation. That’s archaeology of the future. Armstrong wants a banking charter. Dorsey already has one buddy. And using BTC and his strong belief in freedom to distribute the tools people need when charters don’t matter.

One of them understood the assignment.

Thank Mike Benz for this insight as I thought Dorsey was “them” until I saw his tweet.

.Crypto will survive. But not the fantasy version. The version that wins will look suspiciously like the systems it claimed to replace with guardrails, insurance, enforcement, and boring compromises.

So what is freedom?

No income taxes. No government censorship. And anything that Thomas Jefferson so kindly let his pen to.

The right to trade 24/7 I don’t believe is what I saw in any constitution.

We really don’t need Coinbase, we have the Federal government and many states already doing their job in the course of freedom.

Have anything to contribute to the conversation?

Have a question?