Stack Coin or Gold?

A Benjamin Graham exercise, reluctantly performed in 2025

In 1934, Benjamin Graham wrote the legendary book that started many careers Security Analysis.

It is not War and Peace.

It is not Les Misérables.

No Broadway revival is coming.

But if you invest for a living, it is the book that quietly guilts you from the shelf if you have not read it (no skimming allowed).

What Graham really taught was not formulas.

He taught comparison.

What works.

What doesn’t.

And what only works as long as everyone keeps behaving.

So I tried to apply that lens to something modern and slightly uncomfortable:

Not because markets were exciting.

Because they were humiliating.

Five years after 1929, people still wanted reassurance.

Graham offered something else.

Relativity.

He didn’t ask what was “the future.”

He asked how is one’s numbers vs. another.

So let’s do the annoying thing Graham would do.

Compare.

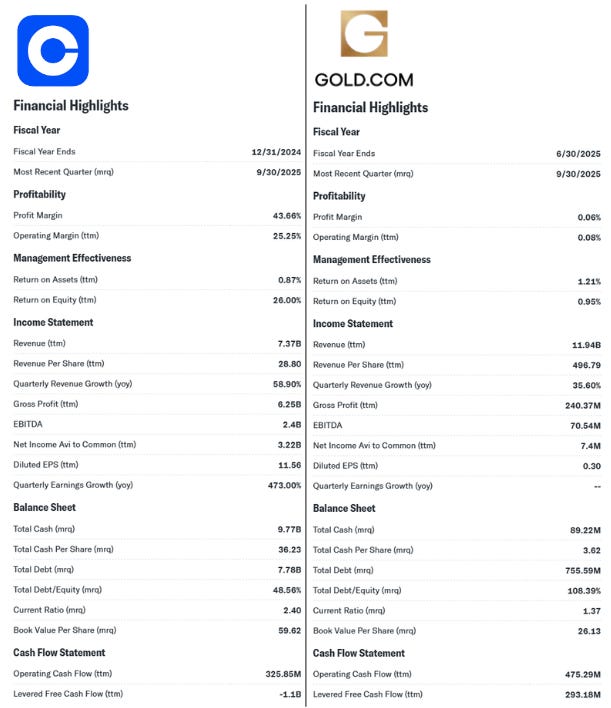

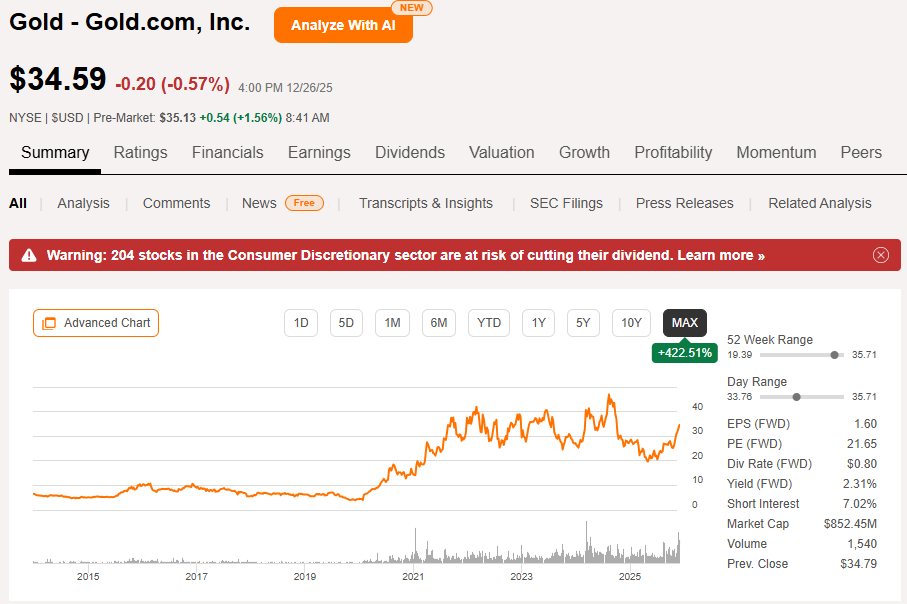

I compared Coinbase with Gold.com.

Which already feels unfair.

One is modern.

One smells like a warehouse.

One has software.

One has forklifts.

And yet Graham would immediately lean toward the forklifts.

Because forklifts do not require belief.

Problem with Coinbase

Coinbase is a very good business.

That’s the problem.

It has high margins.

It has leverage to volatility.

It gets paid whether customers win or lose.

Which sounds wonderful until you realize the entire model depends on people behaving badly.

Trading too much.

Reacting emotionally.

Chasing moves.

That is not a moat.

That is a personality trait.

And personalities change.

Coinbase’s “moat” today is first-mover advantage and regulatory positioning.

Graham would nod politely and ask a question no one likes.

“What happens when this stops being special?”

The Boring Offense of Gold.com

Gold.com is not exciting.

It sells more stuff.

It earns less per dollar.

It carries inventory.

It pays a dividend.

It trades closer to book value.

Which, in Graham-speak, is not an insult.

It means expectations are low enough to survive disappointment.

Gold.com has lived through:

Inflation.

Deflation.

Competition.

Rate shocks.

Boredom.

Graham loved boredom.

Boredom means fewer mistakes.

Earnings Quality, Not Earnings Volume

Coinbase beats Gold.com on margins.

Gold.com beats Coinbase on sales and cash flow.

Graham would not average that.

He would ask why.

Coinbase earns by monetizing behavior.

Gold.com earns by moving inventory.

One depends on conditions.

One depends on operations.

Graham warned repeatedly that earnings dependent on favorable conditions are not the same as earnings supported by assets.

He did not consider those equivalent just because the spreadsheet looks nice.

The Graham Checklist (Paid Readers Would Clip This)

Business understandable without enthusiasm?

Gold.com: yes.

Coinbase: depends on mood.

Earnings repeatable without growth?

Gold.com: mostly.

Coinbase: only if activity continues.

Balance sheet relevant to survival?

Gold.com: central.

Coinbase: secondary.

Valuation assumes perfection?

Coinbase: yes.

Gold.com: no.

Dividend as discipline?

Gold.com: yes.

Coinbase: none.

Competition Is Not a Hypothetical

Coinbase currently enjoys light U.S. competition.

That is a temporary condition, not a trait.

Regulation clarifies.

Fees compress.

Spreads shrink.

Narratives weaken.

Gold.com already operates in a crowded, mature market.

That is not a flaw.

That is a stress test already passed.

Graham preferred businesses that had been insulted by reality and survived anyway.

So Which Would Graham Buy Today?

At these prices?

Graham would not buy Coinbase.

Not because it is bad.

Because it is priced as if it will always be admired.

He would look at Gold.com, see modest expectations, real cash flow, and a valuation close to book, and say something deeply unexciting.

“This one need not be right to work.”

That was always his edge.

Final Thought

Most investors ask which asset goes up.

Graham asked which business still functions when optimism leaves the room.

One business requires excitement.

The other requires Brinks trucks.

Graham always chose the friction over the fruit.

Reluctantly.

Correctly.

Have a wonderful 29th day of December

and not a 1929ish day (except maybe in Silver ho-hum)

Eric

Last days of the year is the time to impulse spend, $5 to get more revelations from me and assistance in making 2026 fabulous