The 30% Club: Where the Smart Money Used to Be

A Mansplainer’s guide to hindsight

Listen, buddy, you missed many moves the past decade, or you wouldn’t be reading my post.

But it’s never too late to make a new mistake, or try your hardest not to create one. We are all human. Some are just retard lucky. But even after saying that, I’m here to share with you a real-time example of one great move in the hopes that in the future, when you have the time, capital, and commitment to participate in great bull runs, you won’t miss out but instead enjoy the rewards over a cocktail or coffee by the beach.

Today, we feature an old name, so old that it came up in 1867—Babcock and Wilcox, the OG of Boilers: B&W.

Of course, the company has expanded quite a lot over the years and developed quite a reputation. Unfortunately, now they are known for the CO2 spewing coal (even if they are not) and a lot of bad projects and debt.

But for companies that have been around for 200 years with technology that evolves and does not become obsolete, there are business cycles, as engineering IP doesn’t die, it just changes sectors.

While my focus was on its sister company, which it spun off, BWXT, and its nuclear opportunities, I never really forgot about the ugly one. It may not be lovely, but it still maintains its virtue.

So, from what I read (and I do need to delve more closely), it currently offers waste-to-energy, carbon capture, and data center gas modules. Yet, for me, coal is a big driver even as it gets into profitable ventures in alternative energy.

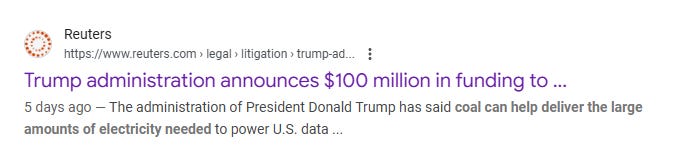

The big news that made me put it on my radar was the White House press release about coal:

April 2025

Coal has not been favoured for awhile now so very good news then at the tail end of October, the DOE is helping advance Coal which will require service providers, like B&W, to help out.

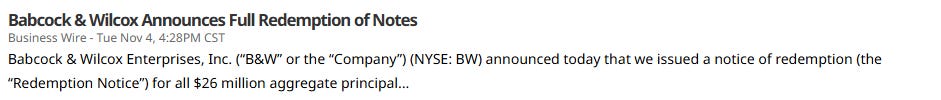

Then if it couldn’t get better, B&W is paying down its debt

BW’s most considerable overhang was leverage. Each dollar of debt retired reduces default risk and raises the equity’s claim on future earnings. Then came the surprise flex: BW announced it’s redeeming all $26M of its 8.125% notes early.

Translation: they’re paying off debt at full price, in cash.

A company that once begged for lifelines is now cutting interest checks like it’s back in control.

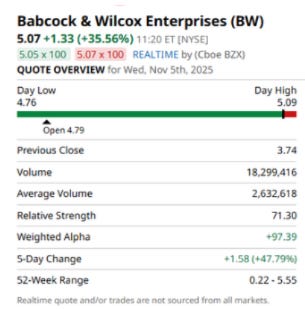

There’s probably a lot more to dig into, but the stock has traded between 45 cents and $6, and at these low prices, the trend, at least for me, is more important than the minutiae. When the narrative flips from desperation to discipline, that’s usually when you want to start paying attention.

Here is the recent results of B&W, Stock symbol: BW

Today, for those who take the 7-day trial, an options trade that should play out over the next few months.

Have a good weekend