Trump's Greenland Focus

Three Companies Positioned for Repricing

Trump just doubled down on Greenland.

And this time, he isn’t walking it back.

We watched him follow through in Venezuela last week.

Now Greenland is back on the board.

This isn’t about speeches or politics.

It’s about policy gravity — and where capital moves when attention returns to places the market has written off.

I’ve been tracking Greenland-related assets since Trump’s first administration.

Not because they were popular.

Because they weren’t.

Why Greenland matters now

Greenland holds some of the richest deposits of rare earth elements, lithium, and strategic metals on the planet.

These aren’t theoretical resources.

They’re inputs for defense systems, energy storage, semiconductors, and industrial supply chains.

It’s also why Greenland has quietly attracted sovereign interest, billionaires, and long-cycle capital for years, even while public markets lost patience.

When policy focus reappears, repricing tends to be violent.

Not because assets changed — but because attention did.

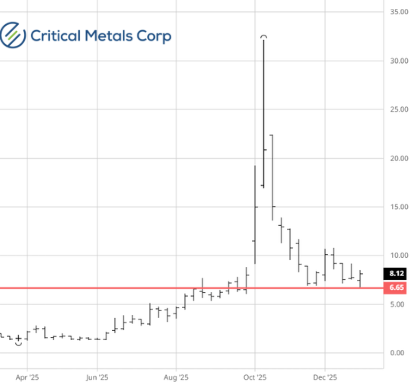

The one stock that is commanding the news is Critical Metals, which trades on the Nasdaq, and you may have found it on Google or Reddit doing research on your own.

It’s a great company, as you can see here, it’s trading at the level of its amazing breakout a few months ago.

But if you are looking for a financially geared US company with a unique niche or a speculative opportunity that can, just for starters, go from 7 cents to $1.00 without breaking a sweat, then read below.

But first, some backstory…

Awhile back, there was a company in Minnesota controlling one of the largest known nickel deposits in the United States.

Regulators stalled it.

The stock collapsed.

Sentiment turned radioactive.

Then, at the tail end, Glencore, the international commodities giant, bought it for peanuts.

For those who held through the drawdown, or bought at the bottom, it wasn’t a disaster. For some, it was profitable.

That pattern shows up again and again in resource markets.

Projects of that quality don’t usually fail on geology.

They fail on timing, politics, and capital structure.

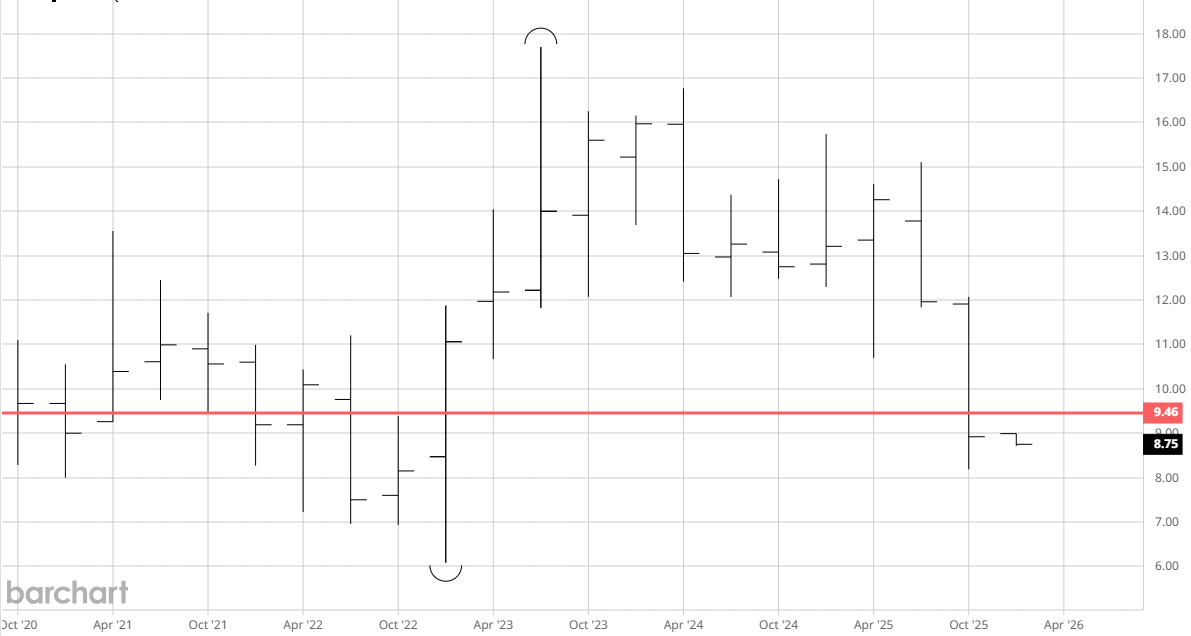

This company used to be valued at $1.00 when rare earth had its previous day in the sun.

This is for investors who understand that you either win big or it does nothing.

This is the Polymet lesson — applied differently.

The issue here does not hinge on a question of legitimacy or rights or even if Trump will “takeover” Greenland. It’s over a very valid lawsuit that may or may not be won due to politics.

But if Trump indeed takes over or exerts US influence, the chances of the company mining should increase.

Here is the chart:

2. The US giant

There is a new business structure that is finally available to investors. This structure IPO in 2020 and is now trading at its IPO price.

It finances very specific projects and has won billions of money for itself and clients.

The reason it is experiencing a period of uncertainty is that it’s hard to collect settlements.

An eccentric character I know is having a hard time to just collect $250,000 from the lawsuit he won against his HOA at his Condo develop, so imagine billions of collectibles.

If you want to know the names of the two additional mystery stocks subscribe and receive additional info and be part of my book club.

You were provided a wonderful company in my musing above, and as usual, you have a chat to speak with me, but if you want to dig deeper, you know what to do.

Have a great Monday afternoon.

Eric