Warren Buffett Can Now Buy a Boat

Post-mortem on Buffett last hurrah and Why the Market Isn't Done Yet

As I shared with clients, normally you sell the news… so when markets ripped as the shutdown ended, it looked like a low-risk opportunity to trim.

Yesterday I read that, after people kept calling out Michael Burry for being flat wrong, he rage-quit and is closing his hedge fund. If you’re not aware, he’s the celebrity hedge fund manager from The Big Short—both the Michael Lewis book The Big Short: Inside the Doomsday Machine and the movie, where he’s played by Christian Bale.

The ego and fame he got from that run probably lifted him six inches off the ground. The “man of the people” routine disappeared quickly, because his public track record afterward didn’t help anyone make money—which is why we listen to our profits (or is it prophets?) on CNBC.

Ironically, the day he quits, the market reverses… for two days straight. Then, on Monday, Warren Buffett releases his latest and last letter as CEO of Berkshire Hathaway. Sixty years, sixty letters. It will be studied and revered for its insight. Whether or not these things predict anything, they always mark an inflection point—or at least give us a moment to pause and reflect.

Sixty years of success, praise, and honestly mindless adulation of Buffett has certainly gone to his head—subtly, and I modestly call it pride. Not in a bad way. He did it his way, showed up every day, and he’s proud of his accomplishments. And now that same pride told him to show himself out, because he expects a market crash of epic proportion. I have no doubt about that.

Buffett doesn’t short anything (that we know of). When he gets bearish, he doesn’t pull a Burry and go hunting for put options or broadcast it on X. He simply steps aside. He closes up shop. He stops buying. Buffett’s version of a crash warning is just doing nothing and hoarding cash, while the entire fan club echoes what they think he’s thinking.

His conception of the world has been right—he’s seen everything under the sun when it comes to business and cycles. But everyone has a prism, a frame of reference. His is based on his upbringing and the extraordinary timing of his life.

Even if he wasn’t born, someone else from his generation would’ve succeeded from the cycle they were given. As he said: “Through dumb luck, [my business partner] Charlie and I were born in the United States, and we are forever grateful for the staggering advantages this accident of birth has given us.”

But even with luck, you still have to grab fate by the horns and ride it, and he did. Here is Warren Buffett this weekend singing his swan song as he leaves the greatest casino in the world—Wall Street—“My Way.”

And what is his frame of reference?

Inflation and Progressive policies.

He would phrase it as “compounding and moat.” Inflation allows nominal growth year after year, and in the right business it keeps compounding. Progressive policies tend to create barriers and friction that allow entrenched businesses to survive the tests of man and time.

His real skill, unlike most, was being ethical and not greedy or unscrupulous—at least by Wall Street standards.

Proof? Let’s do a quick time frame.

The Federal Reserve was created in 1913 by progressive OG Woodrow Wilson (no real work experience, an academic) to smooth out deflation, depression, and bank runs. Everyone applies today’s Fed to yesterday, but no one reads the fine print. Until 1945, the Fed helped everyone except the government. The Fed was allowed to buy commercial paper (corporate debt), trade drafts, bills of exchange, bankers’ acceptances—everything tied to real commerce: inventory, shipments, movement of goods… and that shiny metal, gold.

This was the Real Bills Doctrine—something I never heard of until I had a conversation with ChatGPT—but yes, it’s real. (https://en.wikipedia.org/wiki/Real_bills_doctrine)

The Fed should only lend against self-liquidating commercial transactions.

Then World War II happened. War has consequences. It needs funding. So the Fed, by law, was obligated to only buy U.S. government debt, permanently changing the course of inflation. When governments get spending power and absolute monetary control, they don’t give it back. It just takes time to notice because the U.S. was extremely productive.

Funny how Howard Buffett, Warren’s father, loved gold—Ron Paul guys love to quote him—and yet Warren wasn’t in that camp. Because back then the Fed was literally buying gold. Today it doesn’t. Buffett simply likes knowing where the money is and imitating it. Cash is not trash. Funny that now the U.S. government wants to accumulate BTC? Something to watch closely—especially what the Fed does.

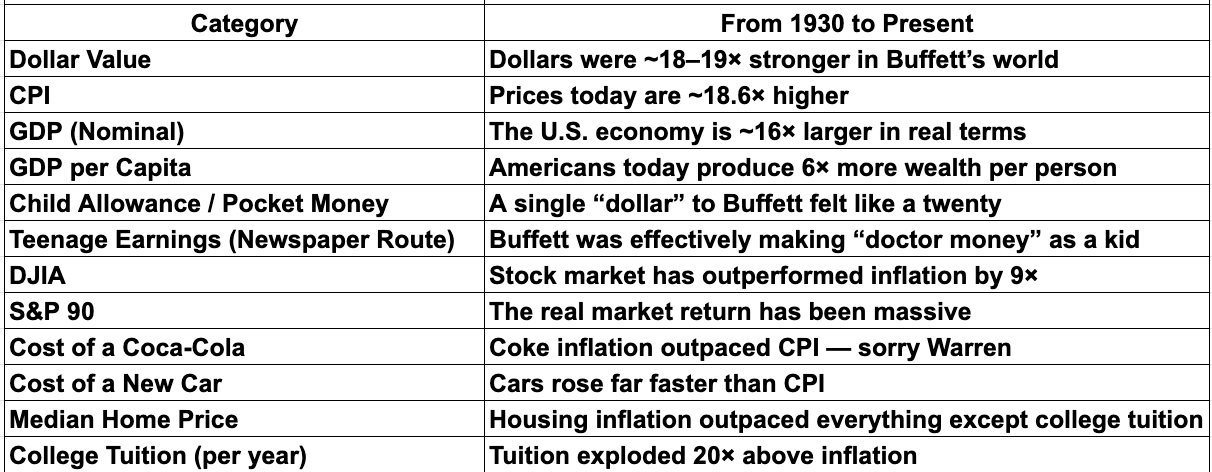

The U.S. didn’t see major inflation until the New Deal. Let’s look at what occurred from 1930 to now.

Everything Republicans (via Trump) and Democrats (via Bernie) complain about is the same core issue: runaway pricing and government-enabled distortions. Both parties helped keep the spiral going.The US didn't really see information until the New Deal. Lets see what occurred from 1930 to now.

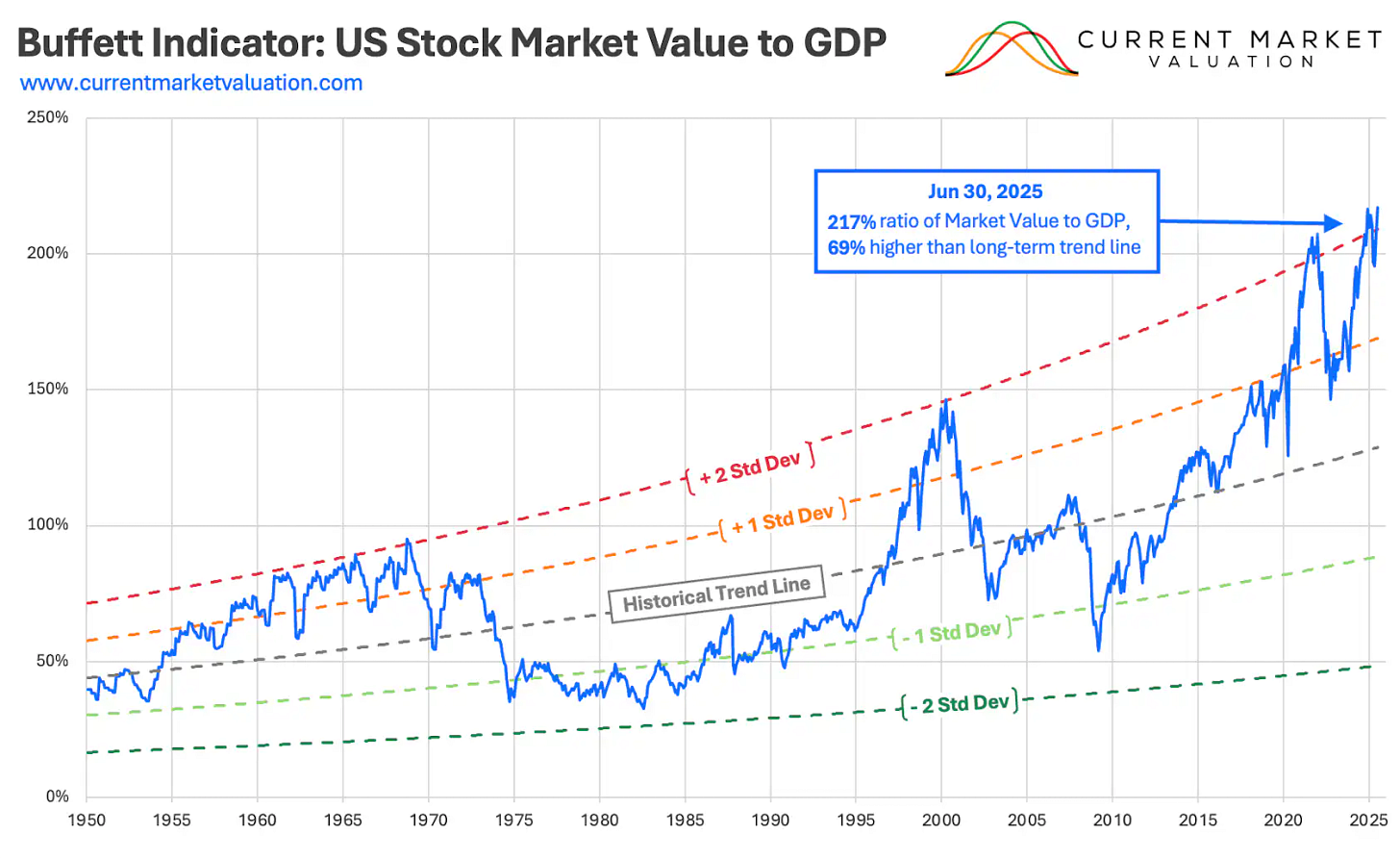

The Buffett Indicator is out of control, without a tether, and now’s as good a time as any to get out when the getting is good—especially tax-free if you’re giving everything to “non-profits” controlled by Bill Gates and the Buffett family.

(Tangent: If you give $1B to your kids, they lose 40% to taxes. If you give it to a charity or foundation, it’s like giving $2B, and you look like a saint. I don’t judge it—I just look at the net effect.)

Now, under Trump—and the current president—we’re seeing something unusual: early signs of reversing those old progressive structures put in place since Wilson. We’re seeing geopolitical tensions reminiscent of the pre-WWII era, tariffs, discussions of lower taxes, reduced EPA burdens, fewer bureaucracies, fewer monopolies, and increased competition. These aren’t progressive policies—they go back to the origins of the country.

It will create volatility, but it will also create an economy of the people and for the people. Competition creates deflation, not inflation. Artificial barriers—of which we have many—are the real culprit. As Elon Musk tweeted about Woodrow Wilson:

So while Buffett shades Musk and Bitcoin and sides with mercantilist China, saying “Envy and Greed Walk Hand in Hand,” referring to Musk’s trillion-dollar pay package (while calling Bitcoin garbage) he’s dismissing two of the greatest investments of all time. And then he praises a mercantilist country that doesn’t value free trade. He may have great timing, but his worldview has limits.

At the end of the day, Buffett is for his partners, not for us, so it’s not always clear what his true agenda is when he shares his thoughts publicly.

What I do know is this: Pride comes before the fall.

“A proud man is always looking down on things and people; and, of course, as long as you are looking down, you cannot see something that is above you.” — C.S. Lewis

So let’s conclude this post-mortem and trace Buffett and the future.

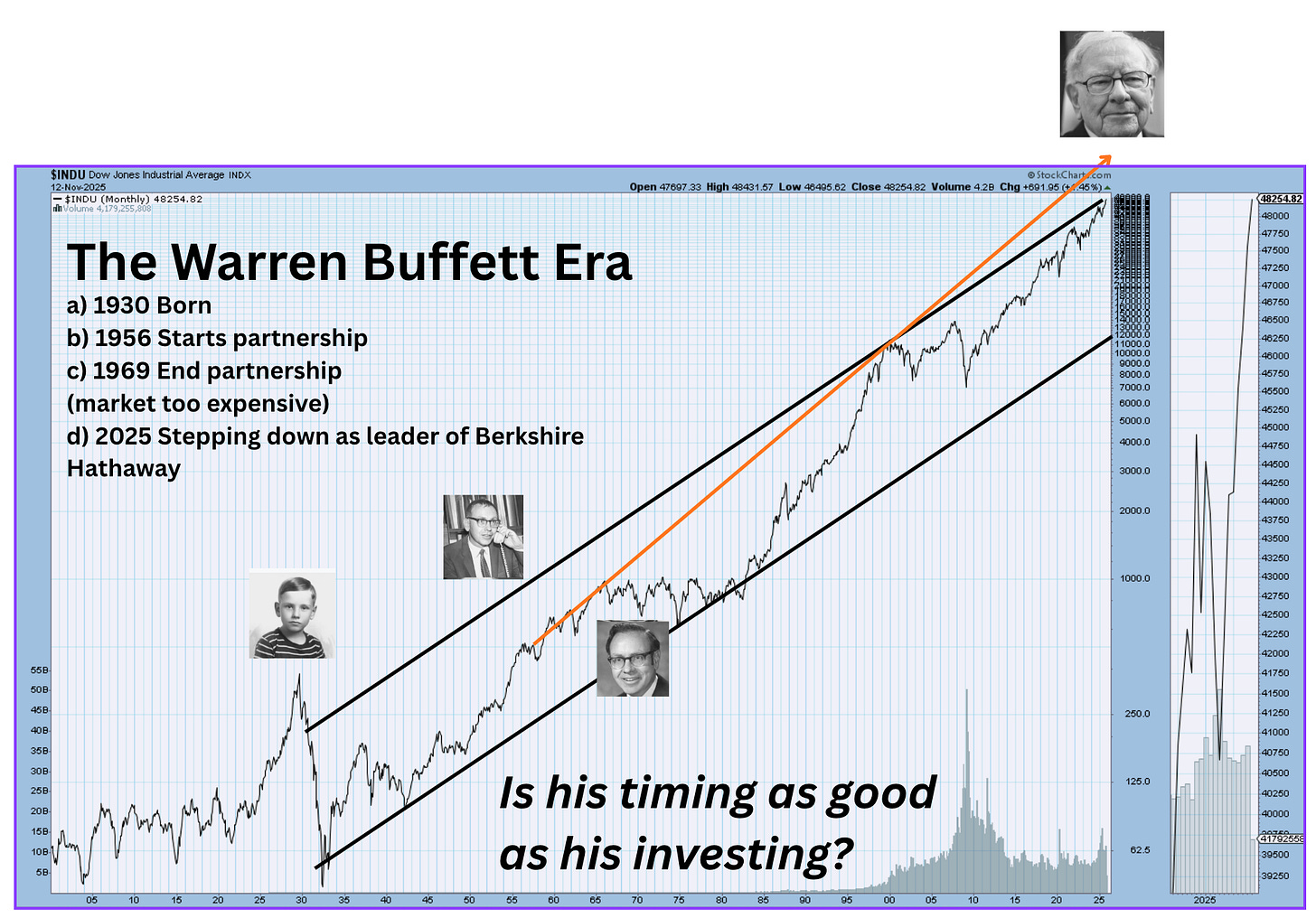

This is a chart of the Dow Jones Industrial Average, the gold standard of stock indexes and the longest-running in the USA. The top black trendline shows the time he was born and the major trend from 1930 to 2000 to 2025—which happens to be peaking now. A good trend should have a parallel line, which is the lower black one.

What’s interesting, and I haven’t seen any CTA or chartist plot it this way, is how sometimes birth itself is a sign. The crash may have been 1929, but the real move down started in 1930.

So Buffett has his Buffett Indicator… and I have the legendary DJIA chart. And mine shows the same thing: the market topped.

LOOK OUT BELOW

And if that’s the case, Buffett’s balance sheet, analysis, and timing will be perfect.

Someone else did the same thing—my dad. In the middle of the greatest commodity bull market (2000–2009), he decided to sell the family metals business because he thought it would collapse like it did in the 1970s and he’d have a chance to buy back in.

That opportunity never came. His competitors upgraded their lifestyles significantly and made sure everyone knew about it.

ORANGE IS THE NEW BLACK.

Look at the orange line. Buffett started his partnership in 1956, just as the DJIA finally corrected the 1929 crash. If we extrapolate a trendline from that point, then the DJIA is just beginning its next slope—just like every business owner starting out in every generation, with hope and expectation that things will work out.

Something my grandmother, may she rest in peace, told my grandfather coming out of the Depression: “Things are going to work out, because they have to.”

But you didn’t come here to hear about my family. Let’s end with the greatest quote on markets:

“So what’s the market going to do? What it always does for 100 years… The basic ideas of investing are to look at stocks as businesses, use the market’s fluctuations to your advantage, and seek a margin of safety. A hundred years from now they will still be the cornerstones of investing.”

We are living in the greatest time imaginable. Let’s seize the moment.

And my tip to Buffett: Buy a boat

Want more, want some relevant time ideas? Subscribe, it’s only $5 to change your life. People usually say for coffee, but it will be for booze.