Why Burberry is more valuable brand than Michael Burry

Plus a Short Idea

There is an old saying on Wall Street “You are only as good as your last trade” and yet Michael Burry is still riding his famed short trade (betting the price of a stock will go down) in 2008 during the housing crisis. His moniker “Big Short” is from the famous book and movie that covers this period in financial history (and nothing to do with any shenanigans at 4 am in Thailand ala the Hangover).

That should say it all.

(We don’t say Coked Buffett, Herbalife Carl, Chipotle Ackman, McNugget Dalio for famous investors)

And yet, his money and his opinion holds weight in the market, this week right before the Big selloff Michael Burry kind of melted down in public. From Yahoo:

Michael Burry’s Scion Asset Management targeted AI valuations detached from fundamentals by taking massive put options on Nvidia (NVDA) and Palantir Technologies (PLTR).

However, Burry just closed his hedge fund and returned capital after his valuation views diverged from markets for an extended period.

Translation:

Everyone wants to know the same thing — Were these shorts recent? Is he losing? Did he close them?

We don’t fully know. But we do know he’s convinced of his views (as one particularly dramatic YouTube short pointed out).

Of course, the largest company in the world, Nvidia, disputed this. It had a very nice rise until yesterday.

Why does Michael Burry have a rough image?

Shorting Stocks in Scale is Tough

Shorting stock is the mirror image of buying stocks and yet betting a price will fall goes against the century long up move in stock prices in addition that without leverage the most you can make is 100% profit with unlimited risk (see all the stocks this year that went up over 1000%)

So the presentation of a short position isn’t always friendly or completely transparent as a result most of the very famous ones kind of just don’t do it anymore.

A great article that covers this is about Muddy Waters which did a good job shorting Chinese stocks but they too had to close up:

“The former owner and short seller Carson Block [for him he is just a “short seller”] the founder of Muddy Waters Capital, found himself in the crosshairs of the federal government. The far-reaching investigation initially targeted dozens of people but ended up with a securities fraud indictment…”

He has been in the news of late which usually occurs when markets are up and looks frothy. But he doesn’t think it’s smart to sell now.

From Bloomberg online:

‘“It’s not the time to bet against the biggest US technology names, according to short-seller Carson Block, even as warnings rise about a potential bubble in artificial intelligence.

“I would much rather be long than be short in this market,” Block, chief executive officer of Muddy Waters Capital, said in an interview on Bloomberg Television. “If you’re out there trying to short Nvidia or any of these big tech names, you’re not going to be in business very long.” ‘

Michael Burry wasn’t listening apparently to that interview, but his twin brother Burberry has an amazing reputation for over 100 years.

How? Why?

From some AI generated search “Burberry is a British luxury fashion brand, founded in 1856, known for its trench coats, iconic check pattern, and high-quality apparel and accessories. Its high price point is due to its long history and brand heritage, the use of premium materials and meticulous craftsmanship, and its positioning as a luxury symbol through exclusive distribution and extensive marketing.”

So, it seems and unlike UK which appears to do everything to ruin its reputation and split up, Burberry is maintaining is image and popularity from its exclusiveness, timeless style, and reliability. This is something anyone must keep in mind.

So instead of having haters, and defenders, you will only have the smug comment of “it’s too expensive.” But wait, they do put a little effort into maintaining the brand.

They “transformed” but slowly when they were confident in their decision. Michael Burry should take that into consideration. He is a young, smart and very good guy apparently. Just a little too secretive for my taste.

As for my two cents on short selling, it’s all about the story short term before the fundamentals. There is no question that Michael Burry and Carson Block know more than an investor does about the businesses they are selling but they need to have more sellers than buyers on their side to profit.

We, as investors, as humans, while fearful tend to be optimistic deep down and give things the benefit of the doubt which is how sell-offs take awhile to get started. Also, short sellers never really smile, who wants to live like that? And we remain dumbfounded as many bag holders of different investments feel now.

Mark Twain, the writer of Huckleberry Finn, quipped:

“A lie can travel halfway around the world while the truth is putting on its shoes”

But…sometimes you can’t help yourself and you feel something in the market is just overpriced or not logical.

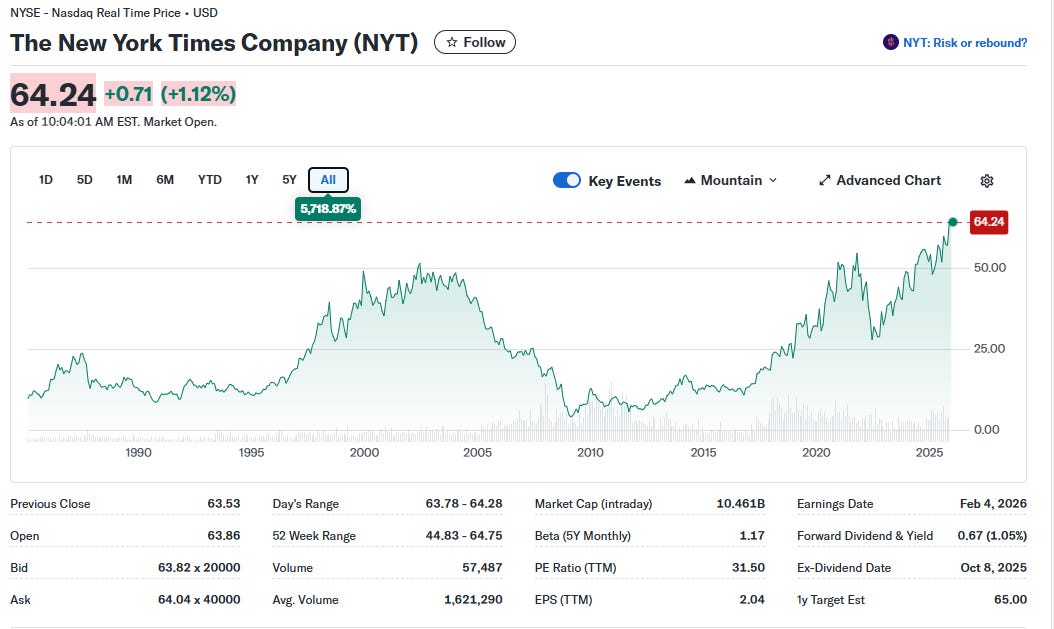

My impression is that NY Times is overpriced; especially if NVDA and the AI interlocking relationships turns out to be true.

Here are my three questions:

The peak in the newspaper business was in 2000, so how can your share price be higher than then? You sold off most of your assets as well. The margins are much lower? (I didn’t open a 10k yet to look)

If the news we read from them is biased wouldn’t their financial statements also be skewed that way?

If AI isn’t helping the AI companies, why would it help NYT

If I didn’t have disregard for the NYT, I would say the company share price is going to $90.

But it is positive that the company valuation is up, it would be hard to be bearish the entire stock market with a bullish NYT.

And yet…

So yesterday, our Software that uses Headlines to create expectations was short BTC (doing very well) and long Apple (up a bit)

And the reason that motivated me to spend time developing it that during the market sell off earlier in the year, the software crushed it.

To observe, and participate, visit the chat.

For paid subscribers, besides the TLC, you will be receiving excerpts of the book I’m writing that not only reveals a strong perspective on investing, it also provides an overlooked perspective on history and tariffs.

Have a nice weekend